Real estate plays a major role in everyday economic survival but housing expenses take up a substantial portion of a household’s budget, leaving little room for savings, investments, or other essential expenses. The increasing cost of living — driven by inflation, utility bills, and everyday expenses — has made it harder for families from the middle-income group to sustain themselves, reported by daily Dawn.

For many, homeownership was a way to build long-term financial security, but with property prices soaring and financing options limited, this is no longer an option.

Owning a home has long been considered a financial milestone, but for an average Pakistani, this goal is becoming increasingly unattainable. Property prices have surged beyond affordability, while stagnant wages and rising inflation make it harder for middle-income households to save enough for a down payment.

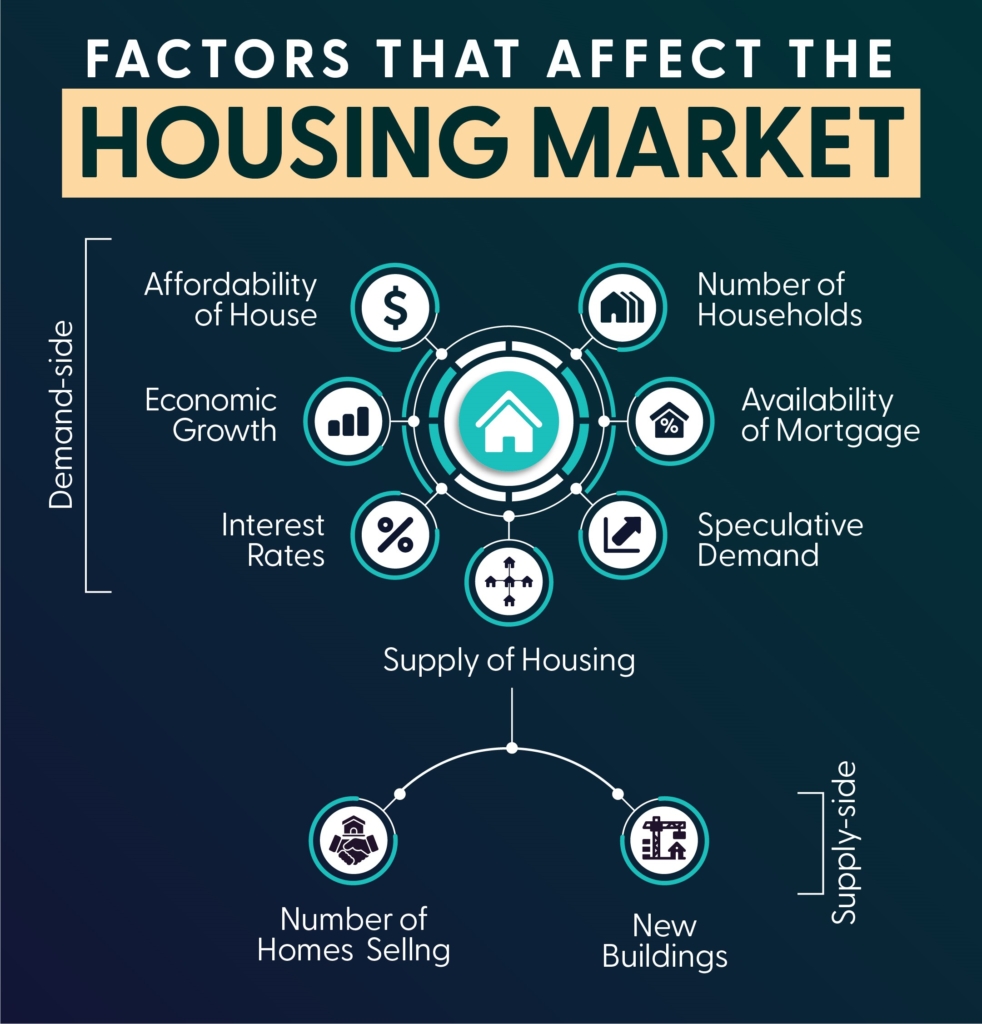

Without intervention, housing will continue to be a financial burden for future generations. Policymakers need to address the affordability crisis by promoting low-cost housing projects, improving mortgage accessibility, and regulating rental markets to prevent excessive rent hikes.

As real estate continues to be a critical factor in economic stability, its increasing inaccessibility raises concerns about long-term financial security and living conditions for millions of people.

“According to the Gallup Pakistan Big Data Analysis of the 7th Pakistan Population and Housing Census 2023, around seven million households, or 13.6 per cent of the total, live in rented properties. Urban centres are particularly affected.

Islamabad has the highest proportion of urban rented homes at 35.6pc, followed by Sindh at 29.1pc, Khyber Pakhtunkhwa at 27.5pc, Punjab at 23.1pc, and Balochistan at 18.3pc. Karachi’s rental market is expanding due to population growth, with areas like Aram Bagh seeing 42.5pc of households in rental properties.”, Daily Dawn reports.

In India, 30pc of the population lives in rental housing, while in the US, 36pc of households are renters. The trend is similar in the UK, where 35pc of households belong to the rental sector. These figures indicate that renting is more common in other countries, but in Pakistan, it remains an unsustainable solution due to rising rental costs and stagnant wages. As rent continues to consume a lion’s portion of household incomes, financial stability remains out of reach for many.

Join The Discussion