The Punjab government has imposed 16% sales tax on commercial property rent from July 1, 2025 under the Punjab Finance Act 2025. This tax will be applicable on all “fixed fee invoices” relating to the rent of immovable commercial property. Only residential houses rented out for personal residence are exempted from this tax. M. Tanveer, patron-in-chief of the United Business Group (UBG), has...

FBR Tax

The Federal Board of Revenue (FBR) has placed hundreds of services into General Sales Tax (GST) in the Islamabad Capital Territory at the rate of 5 and 15 percent, reported in daily The News. For construction services 15pc tax will be charged, excluding: (i) construction projects (industrial and commercial) of the value (excluding actual and documented cost of land) not exceeding Rs50 million per...

The rates of the Capital Gains Tax (CGT) and Withholding Tax on immovable properties would be rationalized in the upcoming budget (2025-26) to facilitate buyers and sellers of real estate sector from July 1 2025, sources told daily Business Recorder. The rates of withholding tax would be reduced on the import of raw materials/inputs in federal budget (2025-26). The rates of withholding taxes would also...

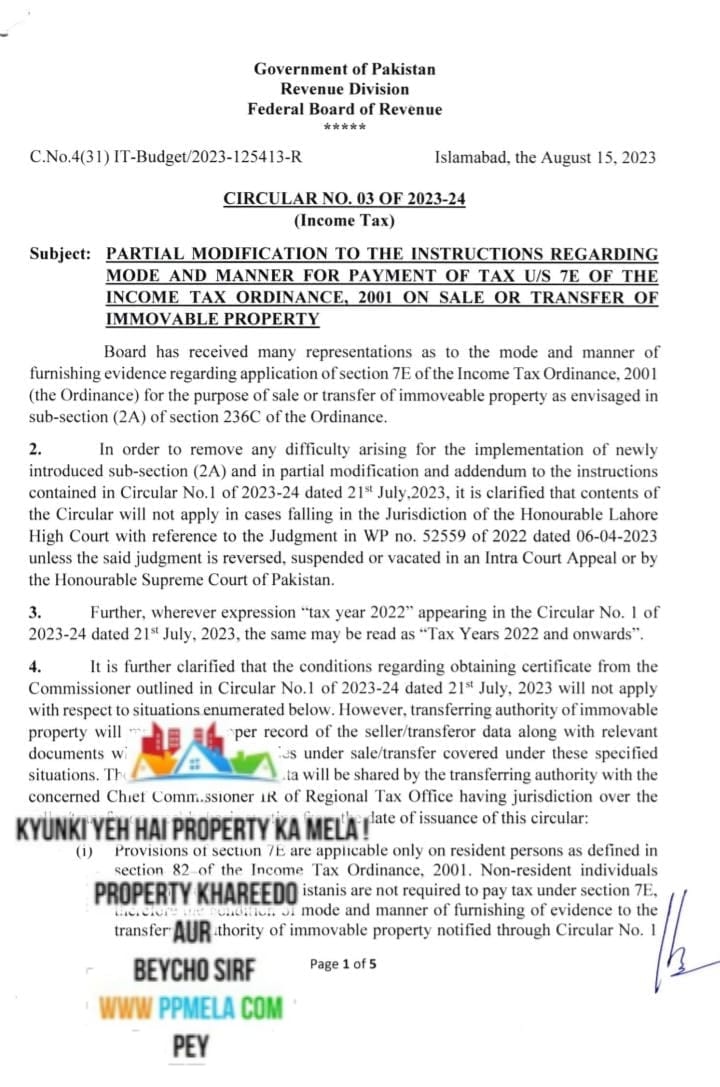

Yesterday, Lahore High Court abolished payment of 1% annual tax on real estate. The Federal Board of Revenue (FBR) has announced that non-resident individuals including non-resident Pakistanis are not required to pay tax on immovable properties under section 7E of the Income Tax Ordinance 2001. The Federal Board of Revenue (FBR) has implemented the judgment of the Lahore High Court (LHC) on Section 7E...